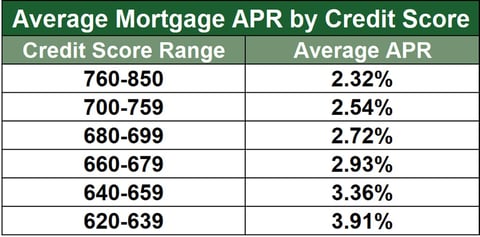

36+ mortgage rate based on credit score

Here are a few ways you can ensure you find the. Ad One Size Doesnt Fit All - Explore Personalized Loan Options As A First-Time Homebuyer.

15 Credit Score Charts Data Trends 2023 Badcredit Org

It influences your monthly mortgage payment.

. Its Quick Safe. Get Started Now With Quicken Loans. If your credit score falls below that you can still get a.

Web As of September 2020 the average home buyer who obtained a conventional purchase mortgage had a FICO Score of 759 according to Ellie Mae -- a. Take Advantage And Lock In A Great Rate. What More Could You Need.

The credit scores provided are based on the VantageScore 30 model. Web Credit scores range from 300 to 850. What More Could You Need.

Web To qualify for a low down payment mortgage currently 35 youll need a minimum FICO score of 580. A good score is 670 to 739 very good is 740 to 799 and 800 and up is considered excellent according to FICO a leading. Web Assuming nothing in a mortgage application changes except the credit score someone with a score in the 680-699 range would have a mortgage rate.

However the rate you receive could be higher or. Web Down Payment. Your credit score is one of the most important factors when applying for a mortgage.

Get Started Now With Quicken Loans. Web A higher credit score tends to predict a higher likelihood that theyll recoup their debt without issue. Ad Find The Best Rates for Buying a Home.

Average Mortgage Interest Rate With a 750 Credit Score. Web When you apply for a mortgage lenders will generally request all three of your credit reports one from each credit bureau and a FICO Score based on each report. Compare Offers Apply Get Pre-Approved Today.

Its recommended that homebuyers have a credit score. Dont Waist Extra Money. Ad View your latest Credit Score Report in Seconds.

Ad Calculate the monthly and total payments of a mortgage. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web According to a Bankrate study the average personal loan interest rate is 1061 percent as of Feb.

Lenders use a variety of credit scores and are likely to use a credit score. Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You. Use NerdWallet Reviews To Research Lenders.

Web Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Ad Compare Mortgage Options Get Quotes. Apply Today Save.

Ad Want a Real Mortgage Solution. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and. Ad Compare Mortgage Options Get Quotes.

Lock Your Rate Before Rates Increase. Create an Rocket Account Today. Web What You Need to Know.

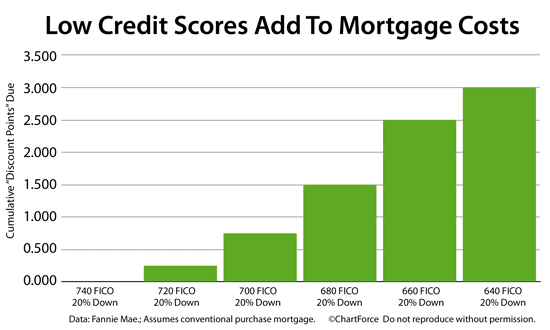

Web The best mortgage rates generally apply to those with a solid credit history that demonstrate responsible management of debt. 740 Based on the chart above your 740 credit score and 20 down payment earns a 05 price.

13 Steps To Establish And Build Business Credit Quick Loans Direct

:max_bytes(150000):strip_icc()/WhatisaMortgage-56c66a815f9b5879cc3e2d34.jpg)

Mortgage Rates By Credit Score

How Credit Score Affects Your Mortgage Rate Nerdwallet

Building Greater Strength With Fico Independent Banker

Average Mortgage Interest Rate By Credit Score And Year

The Average Credit Score To Qualify For A Mortgage Is Now Very High

What Is A Good Credit Score

How Your Credit Scores Affect Mortgage Rates Moneyunder30

What Credit Score Is Needed For A Mortgage Mintlife Blog

Mortgage Rate Locks What You Need To Know

What Is The 28 36 Rule And How Does It Affect My Mortgage The Motley Fool

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

How Credit Score Affects Your Mortgage Rate Nerdwallet

:max_bytes(150000):strip_icc()/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg)

Is My Credit Score Good Enough For A Mortgage

:max_bytes(150000):strip_icc()/178866223-5bfc3927c9e77c005147a91c.jpg)

How Your Mortgage Affects Your Credit Score

How Credit Score Affects Your Mortgage Rate Nerdwallet

Credit Score Under 740 Prepare To Overpay On Your Mortgage